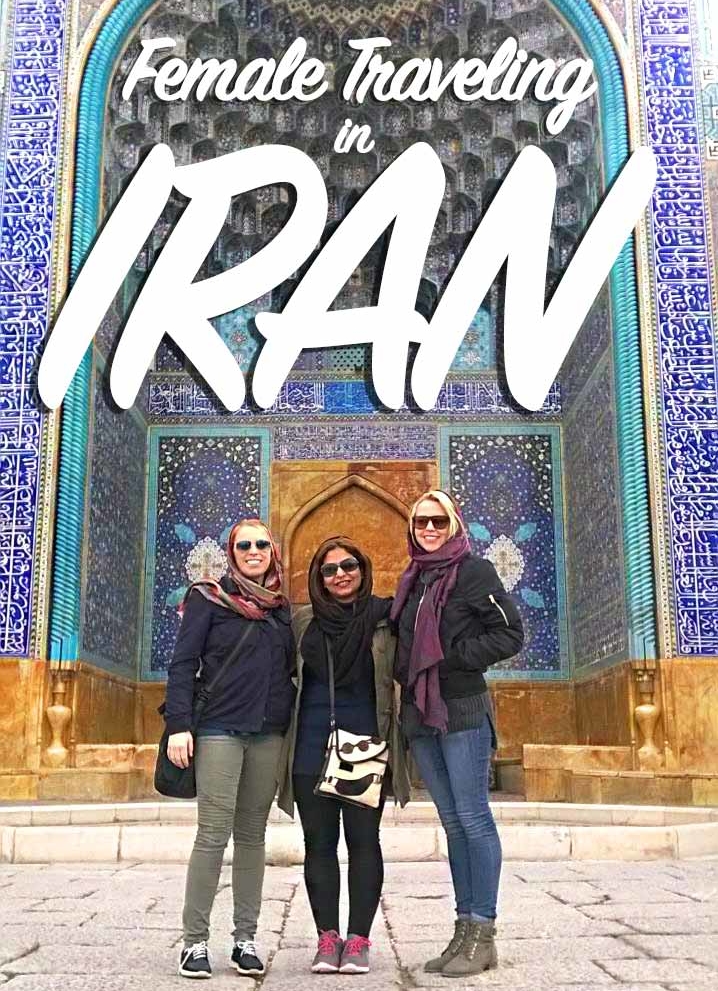

Traveling to Iran in 2025 provides a memorable opportunity to finally discover a country that has breathtaking nature, diverse culture and ancient history. Tourists will be in awe of its unique fusion of modernity and tradition, whether visiting the Persepolis ruins or strolling in the bazaars of Isfahan. But traveling to another country may have its own challenges, dealing with possible travel delays or other risky issues.

Travel insurance is an important part of a travel plan. It is great for ensuring a safe and worry-free experience in Iran. This guide will take a close look at Iran travel insurance to help travelers make a wise decision in 2025.

Why Do You Need Travel Insurance in Iran?

Having Iran travel insurance is required if you are planning to visit the country, because it is mandatory and also protects visitors from unplanned conditions like potential travel risks. This will allow travelers to visit Iran’s wonders without any stress or worry.

Mandatory Insurance for Visa Approval

Iran’s mandatory travel insurance requirement is an essential component of granting visas, since most foreign citizens must provide proof of current insurance. This is true for most countries, except for those in Azerbaijan, Egypt, Armenia, Iraq, Bolivia, Georgia, Malaysia, Oman, Lebanon, Syria, Turkey and Venezuela.

Having insurance is highly recommended in the event of an emergency, and the policy should clearly outline Iran’s coverage. A visa or entry may be refused if you don’t provide the right documentation.

The need for a mandatory travel insurance stem from Iran’s efforts to give access to financial security and healthcare, especially during the sanctions implemented on the country. Travelers should check with their insurer to see if Iran is fully covered, as some international insurance providers can’t cover Iran due to these sanctions.

Risk Covered (Medical, Trip Cancellation, etc.)

Iran travel insurance lets travelers be protected from a variety of risks, including diseases and disrupted travel. Medical coverage is pretty crucial, given the significant difference in the nation’s healthcare systems between urban and rural regions. Travelers who are not covered by insurance will be forced to pay high costs while seeking medical care, especially in private hospitals.

An Iran travel insurance covers doctor visits, prescription drugs, surgeries and hospital stays, as well as emergency evacuations. Trip cancellation insurance guards against financial loss due to unforeseen conditions, particularly because of the country’s geopolitical situation.

Other protections may involve legal assistance, airplane delays, personal liability, accidental death or disability, in addition to reimbursement for misplaced, stolen or delayed luggage. Comprehensive plans handle Iran’s particular difficulties by providing greater coverage and higher limits.

Types of Iran Travel Insurance Plans

The coverage of travel insurance policies for Iran varies to cater to various traveler requirements, travel plans and budgets. Knowing the available options can help you select the best coverage for your trip, ranging from basic plans for short-term trips to comprehensive insurance for prolonged stays or high-risk activities.

Basic vs. Comprehensive Coverage

Those who want to have a quick trip with low risks or are traveling to Iran on a tight budget should consider choosing the basic travel insurance. The basic insurance plan covers important needs, such as covering medical emergency expenses up to €10,000 or lost luggage reimbursement.

The price of this insurance plan starts at €12; therefore, travelers with simple travel plans can afford it due to their reasonable rates. Although, as expected, low-priced insurance policies may not cover risky activities like adventure tours or extended travel delays.

On the other hand, comprehensive coverage offers a broader safety net, which makes it ideal for prolonged trips, families and tourists engaging in a range of activities. Higher medical coverage limits (often €20,000 or more), comprehensive trip cancellation and interruption benefits, compensation for lost luggage and extra protections like emergency evacuation and personal responsibility are all included in these plans.

With all that being said, comprehensive plans are advised because of unique challenges in Iran, which include restrictions that limit access to international financial and medical services. We at Irun2Iran recommend comprehensive plans that can help travelers to be fully protected from unexpected events, ensuring a safe and relaxing trip.

Medical Emergency & Evacuation

Medical emergency coverage must be included in the insurance plan of travelers visiting Iran. The main reasons for this are Iran’s costly medical services and the disparity in the quality of healthcare in different parts of Iran. Travelers who are covered can do surgeries, diagnostic tests, stay at hospitals and purchase prescribed medications.

Emergency evacuation coverage ensures transportation to a suitable medical facility or return to your home country in the event that adequate care is not locally available.

This is especially crucial in rural or isolated parts of Iran, such as the Yazd deserts or the Kurdistan mountains, where access to healthcare may be restricted. Foreign travelers can receive care on time with comprehensive insurance plans, which include extensive evacuation procedures and better medical services.

Trip Interruption & Lost Luggage

Trip interruptions that are critical, such as sickness, geopolitical concerns and family emergencies, can be covered and reimbursed. This is suitable for Iran, where travel plans may typically be delayed due to regional or political developments.

Since Iran relies heavily on cash transactions and has limited access to replacements for lost items, lost luggage coverage provides compensation for lost, stolen or delayed baggage. Higher reimbursement limits and more extensive coverage for travel disruptions, such as airline delays or missed connections, are common features of comprehensive plans.

Specialized Policies (Adventure, Business, etc.)

Visitors can make use of specific requirements for their travel objectives with specialized insurance policies, whether you are an adventurer or a businessperson.

Adventure insurance plans cover dangerous activities, such as climbing Mount Damavand, skiing in Tochal or trekking the Iranian deserts. These policies are quite different from regular plans because of the high risk of injuries or crises.

Business travel plans, as the name suggests, are useful for those who visit Iran with professional means or want to run businesses. This insurance will cover things such as cancellations due to work-related events, work equipment and staying more than usual for conferences and meetings.

Top Insurance Providers for Iran Travel

Choosing an authentic insurer in Iran is very important for travelers. Travelers have to make sure that they are covered effectively and legitimately. Local and international insurers provide plans, but it is important to carefully evaluate penalties and geographical restrictions to avoid coverage gaps.

International Insurers Covering Iran

Because of the U.S. sanctions, many international insurance providers can’t offer Iran coverage under standard policies, making it imperative to select insurers who focus on high-risk areas.

Policies that specifically cover Iran are available from companies such as Direct Travel Insurance, High Risk Voyager and World Nomads; these policies satisfy visa requirements and give complete protection. These insurers provide emergency evacuation, medical coverage and trip cancellation advantages that are specific to Iran’s unique challenges.

Foreign visitors should confirm that Iran is expressly covered by the policy, since vague terms like “Middle East” might lead to claims being denied. By collaborating with reputable foreign insurers to provide simple, visa-compliant coverage options, Irun2Iran guarantees that passengers are securely insured.

Local Iranian Insurance Companies

Local Iranian insurers provide affordable, visa-compliant insurance customized in a way to meet Iran’s unique requirements. These policies, whose rates start at €12 for €10,000 in medical coverage, cover medical emergencies, vacation disruptions, lost luggage and other dangers.

Obviously, local insurance providers can process claims more easily due to their full knowledge of the legal and healthcare conditions in Iran. Choosing these providers is suitable for travelers who come to Iran with a tight budget. This is because the services are more affordable than international options.

At Irun2Iran, travelers are in good hands because we collaborate with local insurance providers that are reliable, making sure visa requirements are fulfilled and dependable coverage for foreign visitors is offered.

How to Choose the Best Policy

When selecting the finest travel insurance plan for Iran, travelers need to carefully consider their travel plans, risk tolerance and financial status. You need to make sure that the policy applies to Iran because the sanctions might make it impossible for Iran to be included in regular international insurance plans.

Consider the length of your trip, the activities you have planned and your medical needs to determine the necessary coverage level. For most visitors, comprehensive insurance is recommended since it provides better coverage, especially for medical emergencies and trip interruptions.

Travelers need to check out limitations and claim procedures while also comparing prices from other providers. We advise choosing policies with clear emergency evacuation clauses and at least €10,000 in medical coverage.

Reading customer reviews and verifying the insurer’s reputation is also important to make a better decision, as this will ensure reliability and make the claim submission easier.

Step-By-Step Purchase Process

Iran travel insurance is very simple to purchase, and travelers can do it in person or online. When travelers adhere to a well-defined procedure, they can rest assured that it is based on visa regulations and can benefit from enough coverage for their whole Persian journey.

Buying Online vs. On Arrival (Airport Policies)

Submitting an online travel insurance is the best way to benefit economically. You can get to compare the insurance plans and get full support that satisfies your visa requirements. Platforms such as Irun2iran provide online ordering with rapid policy delivery through email, to ensure that you have proof of insurance for your visa application or border entry.

Customization is also available with online purchasing, allowing you to choose coverage that fits your schedule, whether it is a long trip or a quick cultural tour. As an alternative, visitors can purchase insurance at kiosks at major Iranian airports, like Tehran’s Imam Khomeini International Airport (IKIA), where plans that comply with visa requirements are available.

Nevertheless, there can be fewer, more expensive, and less flexible choices at the airport. Airport insurance is a reliable backup for last-minute needs, but for convenience and cost savings, we advise purchasing it online.

Documents for Required Claims

Travelers need to present some documents if they want to file a claim. Documents such as a passport, medical reports (for health-related claims), insurance policy, receipts for your purchase and proof of the incident (e.g., police reports) are needed.

Keep both digital and hard copies since processing claims may need hard copies due to Iran’s inadequate digital infrastructure. After an occurrence, get in touch with your insurer right away to start the claim process. Then, follow their guidelines for submitting the claim, which may include online portals, email or in-person visits in Iran.

Iran Costs & Budgeting Tips

Travelers who want a smooth traveling experience need to know the prices of travel insurance based on their budget. The coverage, length of the trip, tourist’s age and scheduled activities all affect the price.

Average Insurance Costs (2025 Prices)

The average cost of travel insurance for Iran in 2025 ranges between $50 and $200 for a single trip, based on things including age, trip duration and coverage type. Basic plans are appropriate for short-term, low-risk travel, starting at €12 for €10,000 in medical coverage.

Comprehensive insurance plans, which range in price from $100 to $200 or more, cover things like higher medical limits, trip cancellation and lost luggage. Premium options can cost much higher due to their high risks, which involve those who are going on an adventure trip or are seniors (Above 60).

How to Save Money on Premiums

It is a good idea to compare prices from many insurance providers to save money. Travelers should focus on those who specialize in travel, like us.

.If you’re going to experience a low-risk and brief travel experience, then choose basic plans to prevent needles coverage for things you won’t do. Booking travel during Iran’s off-season (late fall or winter, avoiding the busiest summer months) and adding insurance to travel packages bought through Iran2iran can lower insurance costs.

If you are looking to reduce the overall cost for each person, then why not consider group insurance. This type of insurance is great for travel groups, friends and families. Pick an insurance that suits your itinerary so that you don’t need to pay extra cash. For instance, if you don’t want to include an adventure tour and want to take a mellow culture tour, then just pay for your insurance for just a cultural visit. Just remember to constantly review the terms of the policy so you are not paying extra money.

Making Claims During Your Trip

If you don’t want to go through the hassle of filing a claim, then make sure to submit a claim as soon as possible after an incident and have the required documentation at hand. This enables you to experience a great and timely reimbursement. You need to contact your insurance company as soon as an incident occurs, whether it’s lost luggage or needing a medical emergency.

You are required to offer detailed information about the incident, including medical records or receipts. Make sure to keep a record of all the communication you have with the insurer and pay attention to their instructions to file a claim.

Due to the cash-based economy in Iran and limited digital infrastructure, it is recommended that travelers keep physical copies of all papers. At Irun2Iran, we assist tourists with the claiming process by connecting them with reliable local and international insurance providers to ensure a timely resolution with ease.

FAQ

What is the best company to get travel insurance from?

We offer comprehensive insurance with visa-compliant coverage starting at €12 for €10,000 in medical protection, in collaboration with reputable local and foreign insurers.

What is the health insurance system in Iran?

Iran has private and governmental medical facilities, although the costs are high for visitors from other countries. Travel insurance, which is necessary for visas, covers medical emergencies, hospital stays and evacuations.

Which insurance is best for foreign travel?

Irun2Iran’s comprehensive insurance plans, which provide medical issues, trip cancellation and lost luggage insurance for international travelers, are ideal since they exclusively cover Iran.